The Scoop

Ghana and Rwanda are leading the race to deploy Africa’s first small modular nuclear reactors, the head of the industry’s main global trade group said in an interview.

South Africa is the only African country with its own nuclear power plants, and Egypt is building its own, but both are large-scale, traditional facilities. And while several nations on the continent have expressed interest in deploying SMRs — newer technology that is more easily built and scaled — Accra and Kigali have taken the most aggressive steps to build such sites on their territory, Sama Bilbao y León, the director general of the World Nuclear Association, told Semafor.

“We are going to need money, we are going to need supply chains, we are going to need work force, we are going to need many things to develop nuclear” in Africa, the career nuclear physicist said. “But the number one thing that we need is visionary leadership that knows, that has a plan, and moves forward.”

In this article:

Know More

Bilbao y León said that when it came to Rwanda — which in June hosted a nuclear energy summit in Kigali — President Paul Kagame had made clear his government was “very focused on nuclear.” Meanwhile, Ghana had made significant strides in developing its regulatory system and infrastructure, notably its domestic workforce and its partnerships with external experts and other bodies. Namibia and Kenya, she said, had also made progress, but “Ghana is really a little bit ahead of everybody else.” Still, Ghanaian officials have themselves acknowledged that the process is a lengthy one: The official supervising Ghana’s effort to build its first nuclear plant admitted to Semafor last year that the country would miss its own 2030 deadline.

Crucially, Bilbao y León said, African countries did not “want to just be a customer and wait for somebody to bring the technology to Africa.” She added that several nations on the continent that are major uranium producers — in particular Namibia, Niger, and South Africa— were taking steps to expand their role in the nuclear supply chain beyond simply mining uranium and dispatching the metal elsewhere for processing. “There is a lot of interest in making sure that Africa does profit as much as possible from all the resources that exist in Africa, including uranium,” she said, “not just shipping the raw material elsewhere, but actually processing it as much as possible in Africa.”

Prashant’s view

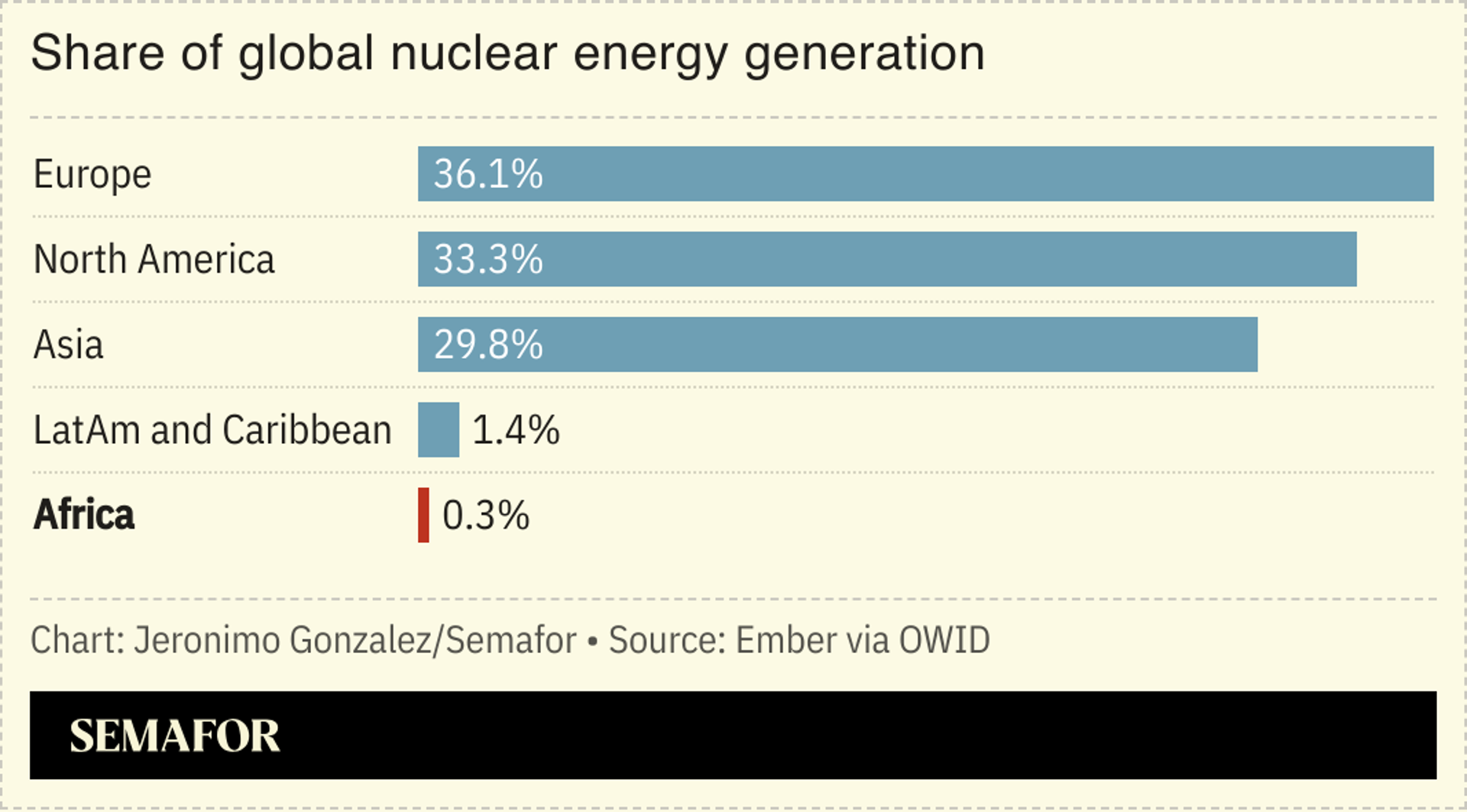

Dozens of countries have signed on to a pledge to triple nuclear power capacity worldwide by 2050, part of worldwide efforts to deploy clean power at scale, and several African countries have expressed serious interest in building out their nuclear portfolios, Bilbao y León said.

In theory, SMRs would fit the bill, and she made a compelling case for them: Nuclear projects in the West have long been imperiled by the huge up-front investment required, the high cost of capital, and uneven public support, despite nuclear plants’ track record of safety. SMRs are, by contrast, cheaper to construct, easier to build into a country’s grid, and ultimately to scale.

The operative phrase, however, is in theory. China, for example, has deployed one, but while many others are planned or under construction, the technology remains relatively nascent. Proponents argue costs will fall when subsequent SMRs are built — “When we are moving from building one power plant every 20 years, as opposed to building 20 plants every year, then we are looking at having a program instead of a project,” Bilbao y León said — but that has yet to be borne out.

And in the time it takes for those economies of scale prove themselves, the price of other forms of renewable power are expected to plummet, too: Utilities and data center operators hungry for “baseload” — non-intermittent, non-weather dependent — clean power are increasingly considering a combination of solar and batteries. Battery costs are falling rapidly, making them becoming a plausible option to displace fossil fuels.

Ultimately, countries in Africa and elsewhere may opt for all of these forms of power together: Faced with rising demand, thanks to both data center buildouts and the electrification of their economies, no single solution will likely be enough on its own.

The View From China

So far, China is the world leader on SMRs, with the world’s first commercial reactor there, Linglong 1, expected to begin operation next year. For China, advanced nuclear tech isn’t just a solution to the country’s own power needs: It’s another avenue through which to exert the country’s technological prowess for geopolitical leverage. At least half of the nuclear power plants under construction globally are being built by China.

Notable

- Few countries are pursuing nuclear power as aggressively as the US, a move that has helped it attract foreign reactor builders, including from Canada and South Korea, the Financial Times reported.